“China’s belt/road, Silk Road, analysis by former ambassador Chas Freeman, the most sophisticated and enlightened analyst in the world today, is a must read to understand the future economics of the world. It also underscores the silliness of the U.S. continuing to bog itself down in the swamp of the Middle East. The hubris of the president and the Congress will deny us a role in this great future.”

Remarks to a Conference of the University of San Francisco’s

China Business Studies Initiative

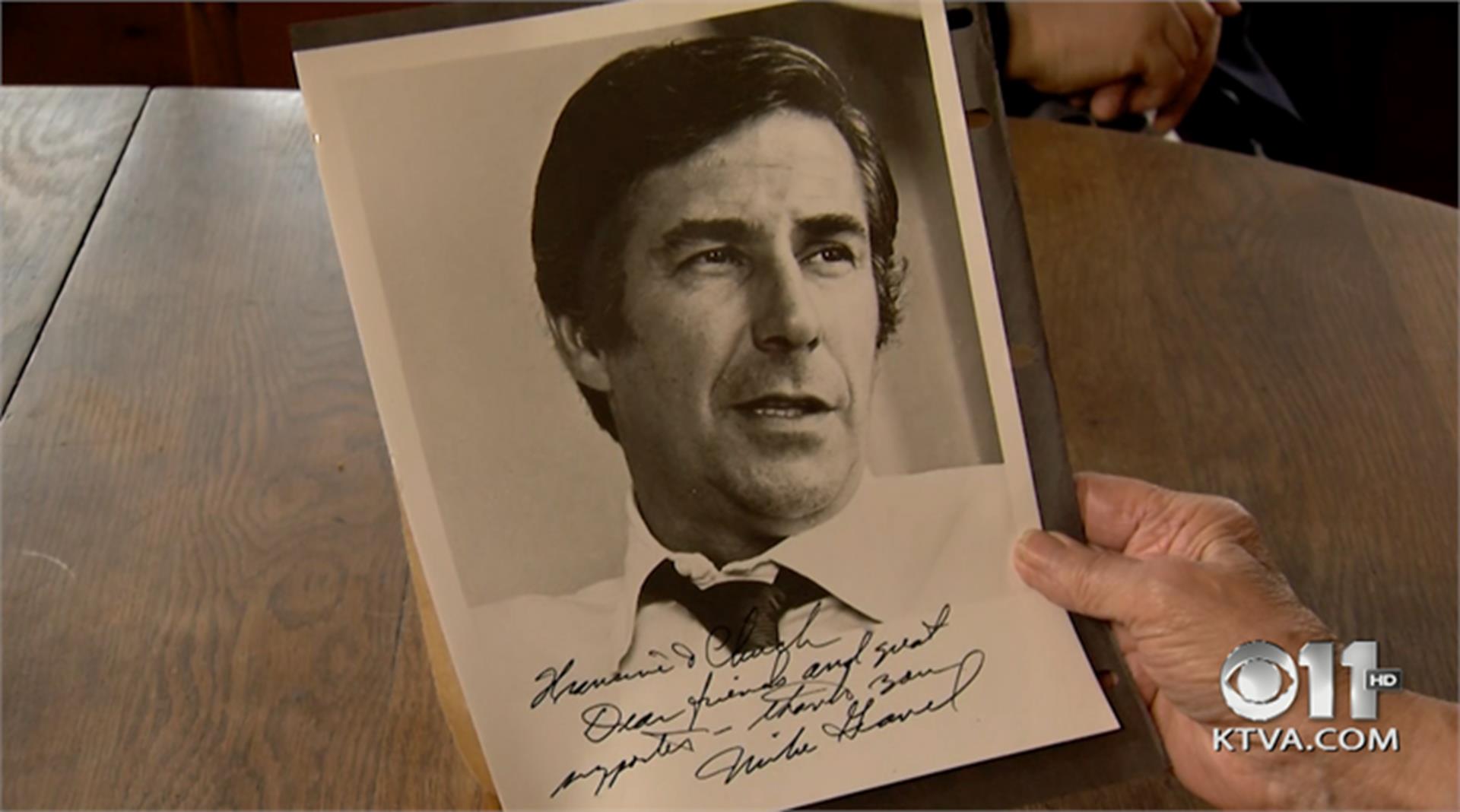

Ambassador Chas W. Freeman, Jr. (USFS, Ret.)

Senior Fellow, the Watson Institute for International and Public Affairs, Brown University

February 8, 2017, San Francisco, California

At Davos, just before the U.S. presidential inauguration this January, Chinese President Xi Jinping made a bid for global leadership by China of trade and investment liberalization. He quoted the opening of Charles Dickens’ Tale of Two Cities.” He recited the first two sentences and left out the rest. It’s worth citing a bit more. Dickens wrote:

“It was the best of times, it was the worst of times, it was the age of wisdom, it was the age of foolishness, it was the epoch of belief, it was the epoch of incredulity, it was the season of Light, it was the season of Darkness, it was the spring of hope, it was the winter of despair, we had everything before us, we had nothing before us, we were all going direct to Heaven, we were all going direct the other way – in short, the period was . . .. like the present period. . . .”

Like the United States, China is now domestically evermore ill at ease. But, unlike America, it’s on a roll internationally. The contrast is striking.

The fading confidence of much of China’s elite in their future stems from many causes. Among these are three thousand, five hundred years of history that strongly suggest that nothing is forever. Progress is invariably succeeded by regression.

As if to validate this historical cycle, more than three decades of remarkable reform, opening, and economic advance in China seem to be giving way to increasingly illiberal, police-state politics, a constipated business climate, and doubts about the prospects for the country’s transition to a new model for continued growth in national wealth and power. Chinese citizens’ attempts to hedge by moving money to safe havens abroad have stimulated Beijing to impose ever-stricter controls on outflows of private capital. Meanwhile, however, declining foreign affection for China is offset by China’s rising prestige and influence.

China’s greater international clout has as much to do with the self-initiated retreat of American leadership as it has to do with China’s return to wealth and power. The indifference of America’s political elite to foreign interests and perspectives as they bear on U.S. policies has grown as the 21st century has advanced. This indifference has just been formalized in the policy guideline, “America first.”

In terms of its approach to global governance and international interactions, the United States now officially relegates the interests of America’s allies, and partners, as well as transnational institutions, to second, third, or fourth place behind its own parochial concerns. American disregard for the impact on others of U.S. policies gives them no incentive to follow Washington’s lead. The U.S. now wants to cut deals, not make rules.

America has just withdrawn from the international consensus that underpins global efforts to liberalize the rules for international trade and investment and to mitigate manmade climate change. The leadership vacuum that the contraction of the Pax Americana was already creating has taken a quantum leap. Ready and willing or not, China is being drawn into an ever-greater role in global governance.

This is the context within which China has been inventing new international financial institutions like the Asian Infrastructure Investment Bank, the New Development Bank, the South-South Cooperation Fund, the China Silk Road Fund, the Maritime Silk Road Management Fund, and the Maritime Silk Road Bank. In the aggregate, these banks and funds are capitalized at almost $300 billion and promise to add $60-$75 billion to annual lending for infrastructure projects in Asia and its periphery. This is considerably more than what Bretton Woods legacy institutions like the IMF, World Bank (IBRD), and Asian Development Bank (ADB) have been able to do. China’s initiatives are game changers.

Most governments other than the United States have been increasing export financing for goods and services companies produced within their borders. U.S. companies that have subsidiaries abroad benefit from this. But, in the absence of some sort of arrangement for U.S. lending agencies to co-finance projects with the new Chinese-led international financial institutions, American companies will find it hard to source goods and services for projects financed by Chinese sponsored institutions from their home market.

The AIIB is off to a fast start, with almost $2 billion in projects already approved. It is not revolutionary in nature. Most of its projects to date have been co-financed with the World Bank and ADB.

Still, the ADB estimates that requirements for investment in infrastructure in Asia are $700 – $800 billion annually, much more than either the legacy or new lenders – or both together – can hope to finance. A lot of money will have to come directly from China, from its partners in infrastructure projects, and from other Asian and international investors and lenders. Some of the money will come from binational joint investment funds with matching bilateral commitments, like the $10 billion fund China has established with the United Arab Emirates. But there will be no shortage of opportunities for independent, non-Chinese lenders to co-finance projects.

The United States has refused to join any of the new banks or funds – apparently to avoid having to appear to defer to Chinese leadership. This has been a foolish forfeiture of U.S. influence. We must hope that the Trump administration – with its emphasis on manufacturing jobs — will find a way to work with China to the advantage of American business. This will be hard if the United States has started a trade war with China. It is a good argument against doing so.

Our mistake in not engaging with the new Chinese-sponsored institutions has been somewhat mitigated to date by the fact that they have not followed the example of their American-sponsored predecessors by barring companies from non-member countries that want to bid on their projects. Many American companies are already subcontractors for “belt and road” projects. These projects represent an unprecedented set of business opportunities on a wider scale than most yet seem to have grasped.

China has set a goal of $2.5 trillion in trade with “belt and road” partner countries by 2025. In support of this, Beijing is doing more than setting up new institutions. It is encouraging mergers, acquisitions, and green-field investments to create what might be called “multinational companies with Chinese characteristics,” some with headquarters in Europe or elsewhere outside China. And it is promoting uniform standards for trade, transport, and communications.

The belt and road initiative is not just the greatest and potentially most transformative set of engineering projects in history, it is the world’s largest emerging platform for international business collaboration. It is often described as a program directed at China’s neighbors in Central and Southeast Asia. But, as the recently opened rail line between Yiwu and London illustrates, its objective it to connect China to Europe, not just to the countries that lie between Europe and China. Its aim is to integrate the entire Eurasian landmass with a network of roads, railroads, pipelines, telecommunications links, ports, airports, and industrial development zones.

The massive infrastructure projects envisaged by the belt and road initiative promise to deliver major increases in the speed of transport and telecommunications, to lower costs, and to create a great many new jobs. They will integrate Russia and Central Asia with both China and Europe, while connecting South Asia by land as well as by sea to the markets and natural resources of the countries to its north as well as to Africa. There is a very good running account of the state of play of projects in Asia (though, sadly, not in Europe or Africa) to be found at the “Reconnecting Asia” website operated by the Center for Strategic and International Studies (CSOS).

Most projects will be overland: Kunming to Singapore and, separately, to Kolkata; Kashi

If this concept of Eurasian integration is realized, it will open a vast area to economic and cultural exchange, reducing barriers to international cooperation in a sixty-five-country zone with seventy percent of the world’s population, fifty-five percent of its GDP, and well over half its current economic growth. At $1.4 trillion, China’s declared financial commitment to these projects is eleven times the size of the Marshall Plan, restated in current dollars. Leveraging will likely at least triple the value of this proposed investment between now and 2049.

Not surprisingly, most observers concentrate on the truly awesome physical infrastructure envisaged by the belt and road initiative and overlook its effort to develop common rules and transport regulations for all of Eurasia. Beijing and its partners seek to improve the efficiency of customs clearance, enable interoperability across different rail gauges, reduce tariff barriers, assure security along transport corridors, and harmonize institutional, financial, and regulatory structures. China envisages bilateral agreements with sixty-five countries to reduce impediments to trade, to create and endow new financial institutions, and to execute enormous infrastructure projects.

In May, China will convene a summit meeting of the countries participating in the “one belt, one road” community, which include at least forty with completed bilateral agreements with Beijing as well as another sixty or so who are engaged in active dialogue about projects. This will move the collective effort to adopt common standards across the Eurasian landmass to a new level. The United States and the American private sector should be there alongside others. If our government does not help make the rules, our interests will be ignored. If our companies cannot get into the game Asians and Europeans have begun without us, they cannot hope to score. What is at stake is decades of enormous business opportunities.

At least 890 projects for new roads, high-speed railways (50,000 miles of them!), pipelines, ports, airports, and inland telecommunications links are to boost the efficiency of overland travel and economic transactions across Eurasia. The vast space from the Atlantic to the Pacific and from the Pacific to the Middle East and the Indian Ocean is to be laced with industrial development corridors and special economic zones that draw on these links to create centers of economic activity. Network effects assure benefits not just to China as the initiative’s leader but to every country touched by it. American companies that make construction equipment and manage construction services should be well positioned to benefit from all this activity. But so are their competitors.

Market-driven extension of China’s expanding logistics system to neighboring countries and beyond had begun even before 2013, when President Xi Jinping first announced his “one belt, one road” concept in Kazakhstan. Today, $20 billion in belt and road-related construction projects (about two-fifths of the Eurasia-wide total) are underway in that country alone. The initiative probably began in part as a measure to alleviate overcapacity in China’s cement, steel and aluminum industries by conjuring up export markets for them. Belt and road projects will let Chinese manufacturing and construction companies continue for a while to do the sort of work abroad that is winding down for them at home. Lending to China’s neighbors so that they can pay for what Chinese companies build for them is a shrewd way both to make friends and to generate better returns than Beijing can get from U.S. Treasury bills.

The initiative may be commercially motivated but it has major strategic implications. It is a way of breaking out of maritime encirclement by an increasingly hostile United States, Japan, and India. It will accelerate the development of Xinjiang and other parts of western China by making them key connectors to Europe and the Middle East through Central Asia and Russia. It gives China’s neighbors to the west a reason to cultivate good relations with it. It will build a huge economic community in which China’s size and dynamism will guarantee it a leading position. It will cement China’s relations with its geographically enormous Russian neighbor.

China’s experience with the impact of expanded infrastructure on its own territory has amply demonstrated the extent to which it can integrate economic geography in an arbitrarily divided super continent like Eurasia. China built its first American-style expressway in 1990. In 2011, the length of China’s expressway network passed that of the United States. It continues to grow. At 123,000 kilometers (76,000 miles) in length, it is now by far the world’s longest. In 2015 alone, China built another 11,050 kilometers (6,870 miles) of expressway.

China’s first high-speed rail line – meaning one that supports passenger or freight trains that travel at 200 kph (124 mph) or more – opened in 2007. At more than 20,000 kilometers (12,500 miles), China’s high-speed rail lines are now by far the most extensive in the world. They have an annual ridership of over 1.1 billion passengers. China expects to lay another 15,000 kilometers of track by 2025.

All these new roads and railways in China connect to vastly expanded airports and ports. In the last five-year plan (which ended in 2015), China built 82 new airports and expanded 101 existing ones. Over eighty percent of Chinese are now within 100 kilometers (62 miles) of an airport. By the end of this decade, this percentage is to rise to nearly 90 percent. A similar wave of expansions has given China seven of the world’s ten largest and busiest ports.

Accompanying the explosive growth of Chinese transportation infrastructure, which includes some of the world’s longest oil and gas pipelines, have been fiber optic cable and power transmission lines. Last year, China laid 2.6 million kilometers (1.6 million miles) of fiber optic cable. 80 percent of Chinese broadband users are now on fiber, making China number one in the world in terms of the proportion of broadband users on mobile devices. Meanwhile, China is the first nation in the world to build a grid based on long-distance ultra-high-voltage power transmission, a technology in which it has become the global leader.

China has reaped many of the same economic benefits from this expanded infrastructure that the United States did in the last century from the combined effects of the opening of the Panama Canal and the interstate highway system. But China’s gains have come in a much compressed time frame and their momentum has yet to flag. There is a logic to China’s connection of internal networks to external ones and, where these don’t exist, building them.

It should be obvious that the “belt and road” initiative also carries significant economic and political risks for China, as well as for recipient countries and local communities. The availability of credit does not guarantee the availability of financially attractive projects. The institutions China has created to support it expect to make a profit on their investments. At the moment, there is still more money on offer than there are economically viable projects. That is a recipe for corruption.

Then, too, China has a record of making extravagant offers of credits abroad that are then underutilized. This justifies a certain measure of skepticism about the numbers China has attached to its aspirations. Not all of the money China is making available will find projects. Still, given China’s emphasis on collaborative planning with foreign partners, a good deal of it seems certain to be used actually to build things.

A majority of Chinese private sector and state-owned enterprises in the construction, mining, and telecommunications sectors have built utilization of belt and road credits into their business plans. Every province and megalopolis in China is developing specific plans to support “one belt, one road” projects. A large part of the work on these projects – as much as seventy percent, if past practice is a useful guide, but far from all of the work – will be done by Chinese companies.

China’s economic planners want to make private enterprises the backbone of the scheme – to leverage their energy, flexibility, and sensitivity to investment efficiency. But the initial emphasis on state-owned enterprises replicates the infrastructure-investment-led approach to development that has run out of steam in China’s domestic economy. The best that can be said for this is that it gives such SOEs an opportunity to ease their transition to a new system with new rules and practices. They can continue for a while to do abroad what they will have decreasing opportunities to do at home.

China’s private sector companies are very good at exploiting opportunities for investment fueled by credits from the Chinese state. But, for the program to succeed over the long term, the planning process that is getting under way will have to begin to develop new models for Chinese investment that empower private enterprise along the Silk Road as well as in China itself. Perhaps the key to accomplishing this is partnership with foreign companies and lenders with greater experience in risk-based lending and turning a profit outside home markets.

As the late Deng Xiaoping would have put it, China and its foreign partners will have to find their way across the many rivers between the Atlantic and Pacific by feeling their way with their feet as they ford them. Some projects will be financially attractive or made so. Others may be more problematic. The market will decide.

This raises a key question. Many of the countries that lie between China and Europe have troubled political and economic environments and well-deserved reputations for corruption. What return on investment can China and its partners reasonably expect from projects there? There is clearly a risk that projects will fail the test of due diligence or that the money that is lent to smaller countries will create debt that they cannot repay.

In the short term, on the macro level, even under conservative assumptions, investment in Asian and European infrastructure looks like a good bet. Chinese state-owned enterprises have more money for infrastructure build-out than they can profitably deploy in China, where returns on such projects are very low at present. Investing in roads, railways, fiber optic cable, and power generation and distribution assets outside China could enable the productive use of China’s industrial overcapacity, stabilizing employment and the Chinese economy.

One study estimates, for example, that a relatively modest five percent growth rate in such assets from their current base could create 137 million tons of demand for Chinese steel. This would reduce oversupply in the Chinese steel industry from 22 percent to 8 percent. It would expand access to markets and natural resources to China’s West, while linking both to the Chinese economy. It would also offer a new outlet for the investment of China’s huge foreign exchange reserves, which have been concentrated in U.S. Treasury bonds and other instruments with very low yields.

As another example, consider the benefits of shorter, land-based telecommunications routes that connect the two ends of the “world island.” China is connected to Europe at present by 39,000 kms (about 24,000 miles) of mostly underwater cable following legacy telephone links. Digital packets transmitted from Western Europe to Shanghai or Tokyo must either cross Europe, the Middle East, the Indian Ocean and the South China Sea, or transit the Atlantic, the United States, and then the Pacific Ocean. Too many cables pass through heavily trafficked choke points like the Strait of Malacca or the Suez Canal. Accidents in these choke points cause several hundred disruptions of the global undersea system each year.

Trans-Eurasian networks will be more stable. They will not just improve connectivity for landlocked countries along the “one belt, one road” routes but also speed up data exchanges between Europe and Asia. Investors are willing to spend hundreds of millions of dollars to gain a few milliseconds in highly profitable “high frequency trading,” the automated buying and selling of financial instruments by computers. By some estimates, a one millisecond advantage could be worth up to $100 million a year to a single hedge fund company. Shorter routes are the keys to speed – and profit. And routes under Chinese, Russian, and European control will arguably be more secure from exploitation by the much-feared U.S. National Security Agency.

The devil is always in the details, but if China’s vision is realized in any significant respect, in time all roads and other physical linkages in Eurasia will connect to Beijing. China will become the center of economic gravity of a vast, loosely integrated region that already has 55 percent of world GNP, 70 percent of global population, and 75 percent of known energy reserves. The belt and road program includes no explicit military component, but it clearly has the potential to up-end the world’s geopolitics as well as its economics. It is an entirely non-coercive, market-directed means by which to aggregate all of Europe and Asia’s wealth and power to China’s own as China becomes by an ever-increasing margin the world’s largest economy.

If it works, the belt and road initiative will place China in an ever more central position of influence on the Eurasian landmass and the world. It will, in short, make China the most important single national actor on the entire Eurasian landmass. And, if China’s commercial partners, including those in the United States, play our cards right, we will be able to harness China’s rising prosperity to their own. If we don’t, others will.

SOURCE: http://chasfreeman.net/the-geoeconomic-implications-of-chinas-belt-and-road-initiative/